Claims can be submitted via the Paywise App (Android or Apple) or our Member Portal.

Paywise App instructions.

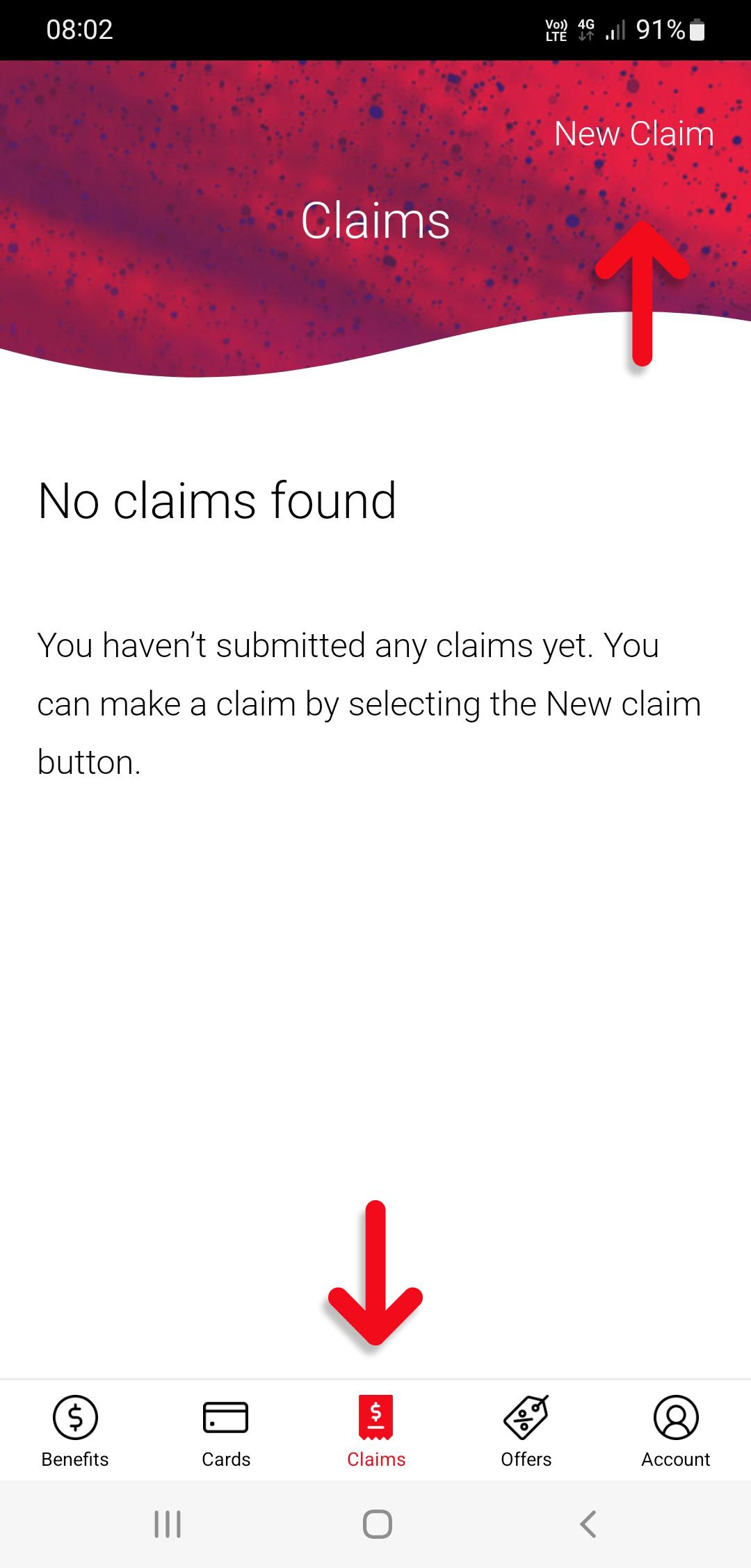

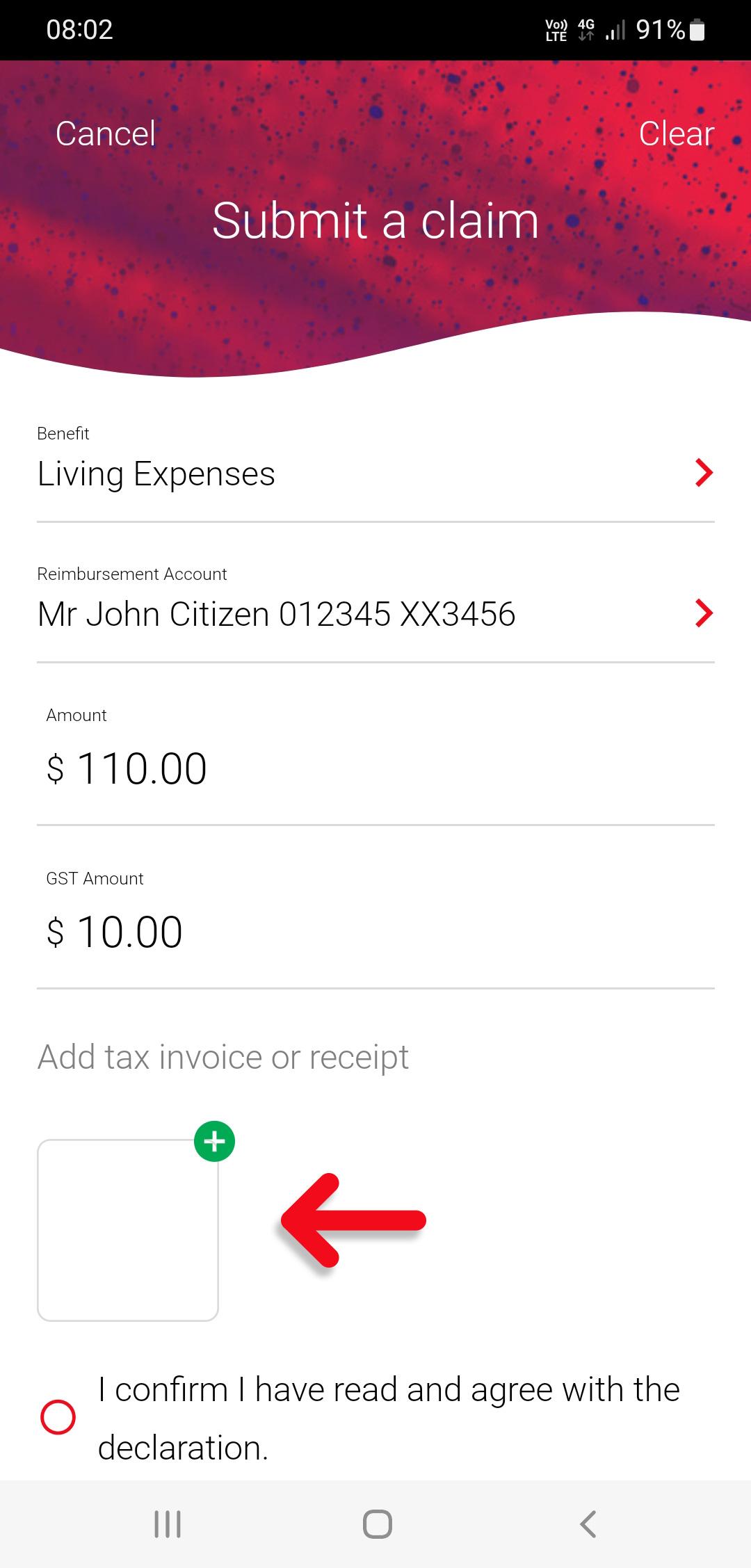

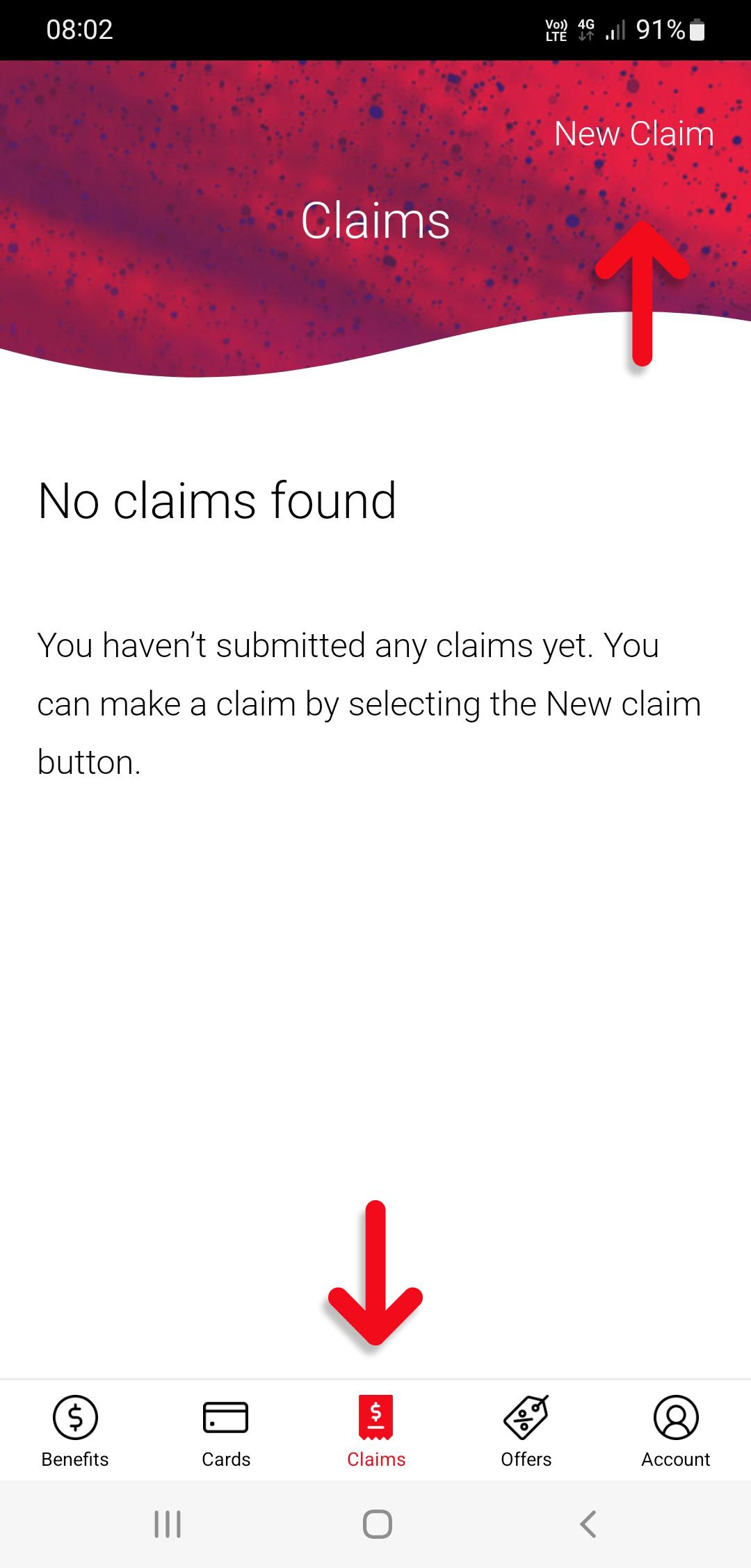

1. Once you’ve opened and logged in, choose ‘Claims’ in the footer menu, then ‘New Claim’ at the top of the screen.

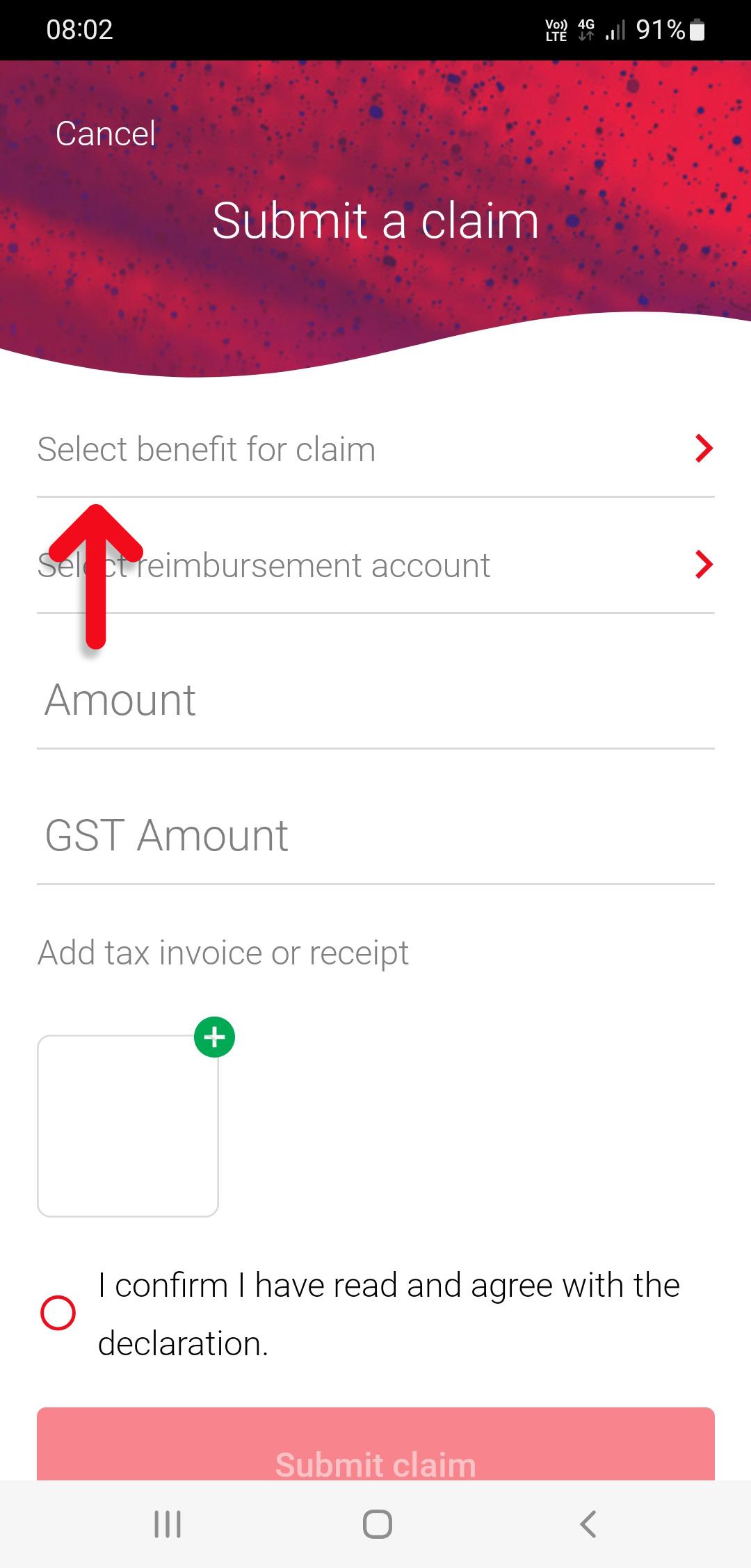

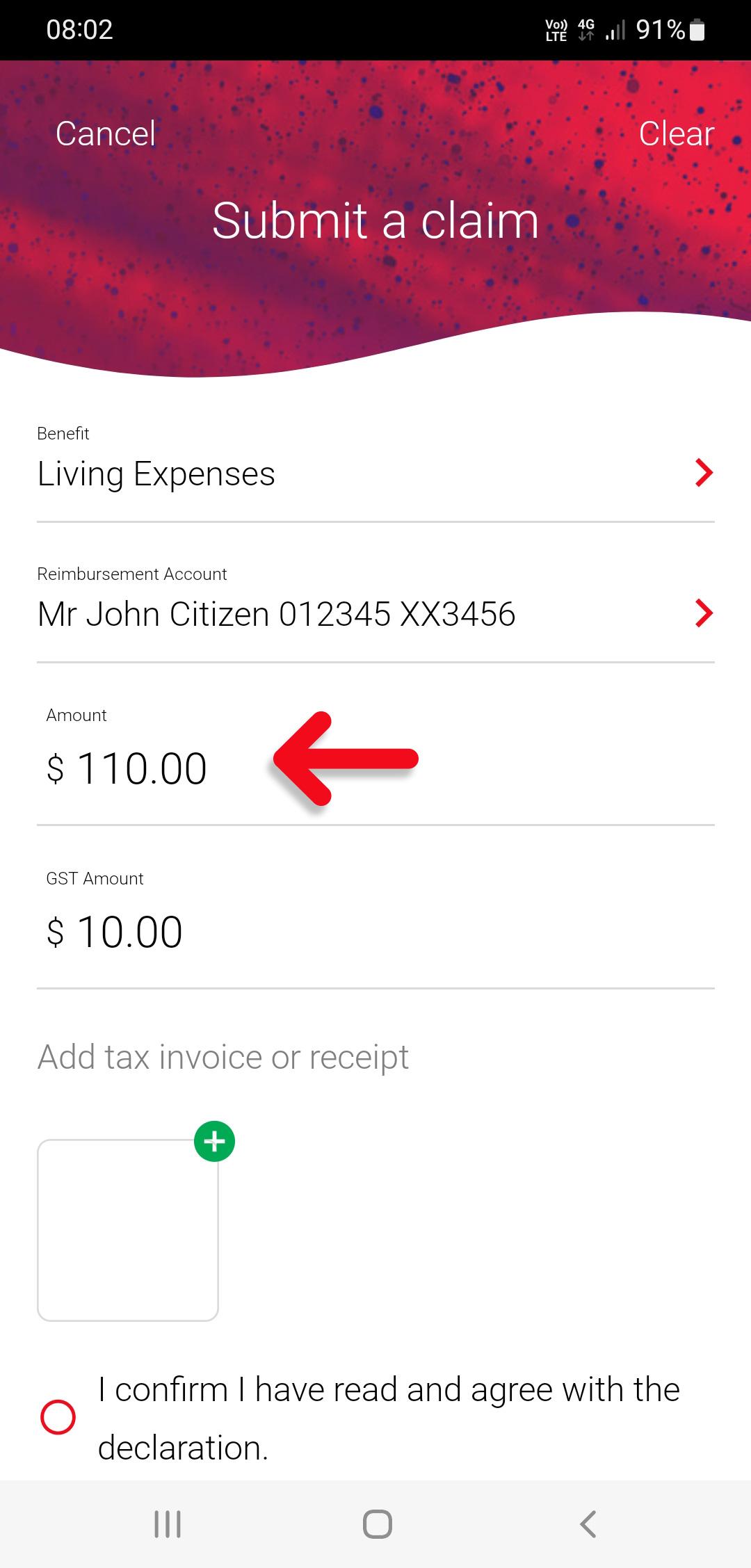

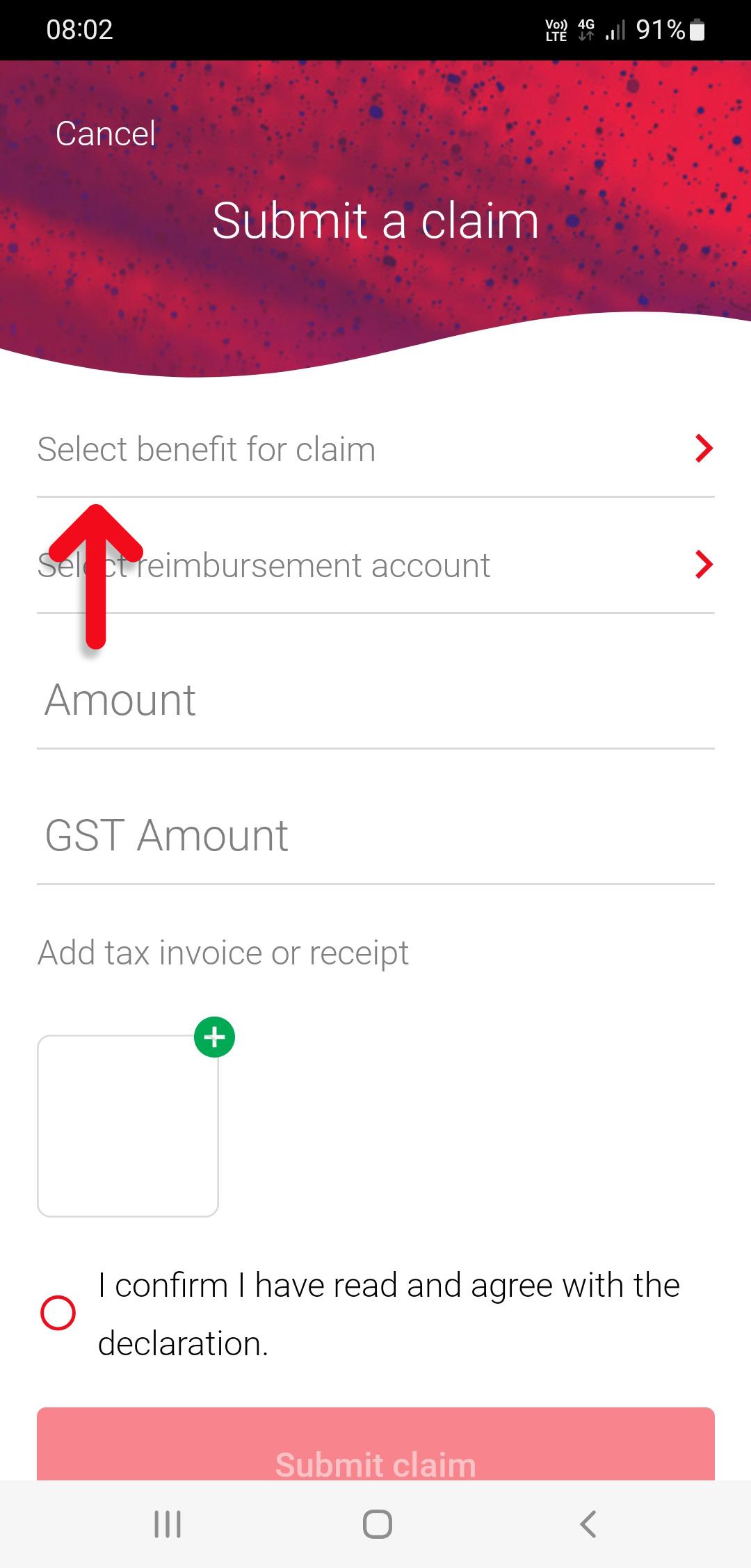

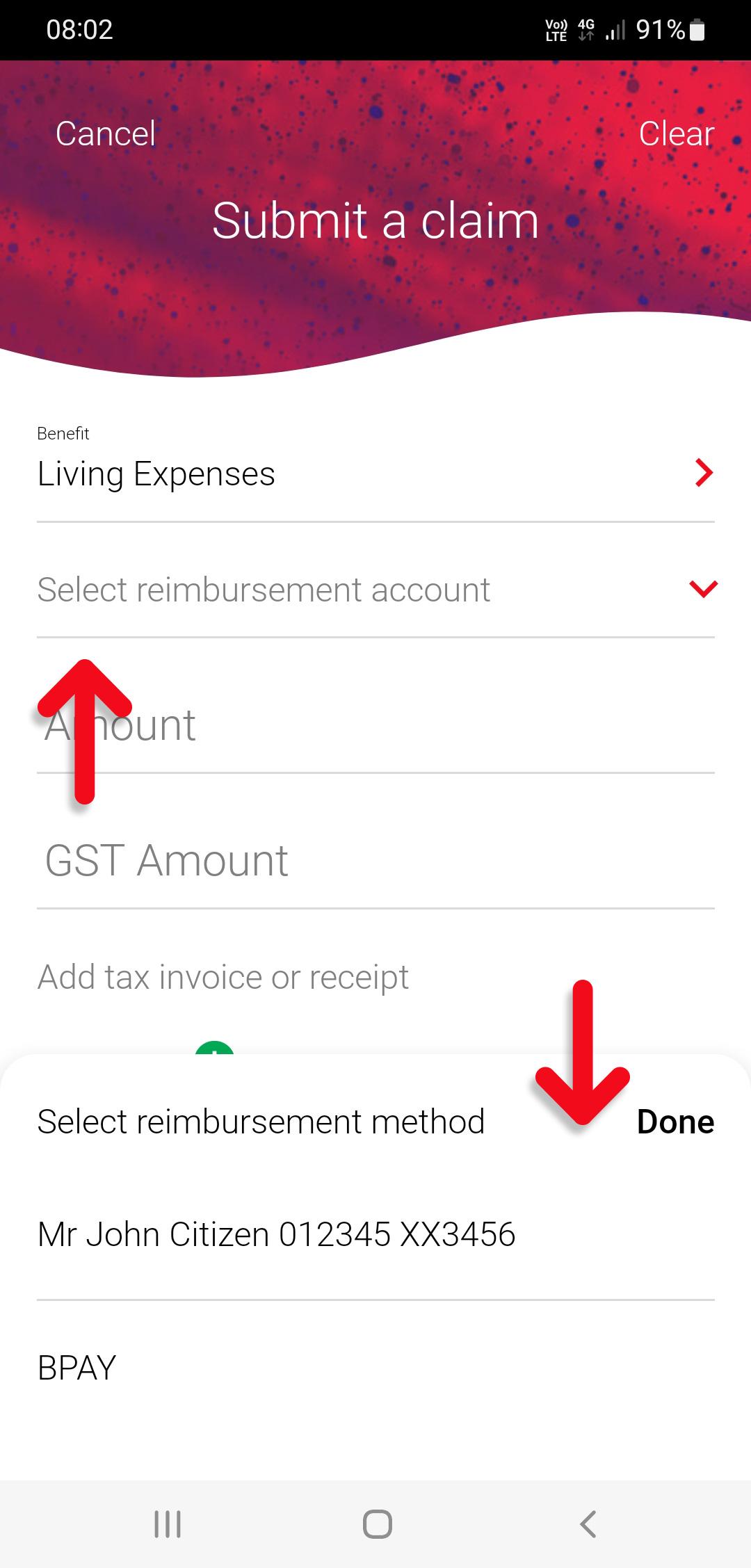

2. Choose the benefit your claim relates to, eg ‘Living expenses’.

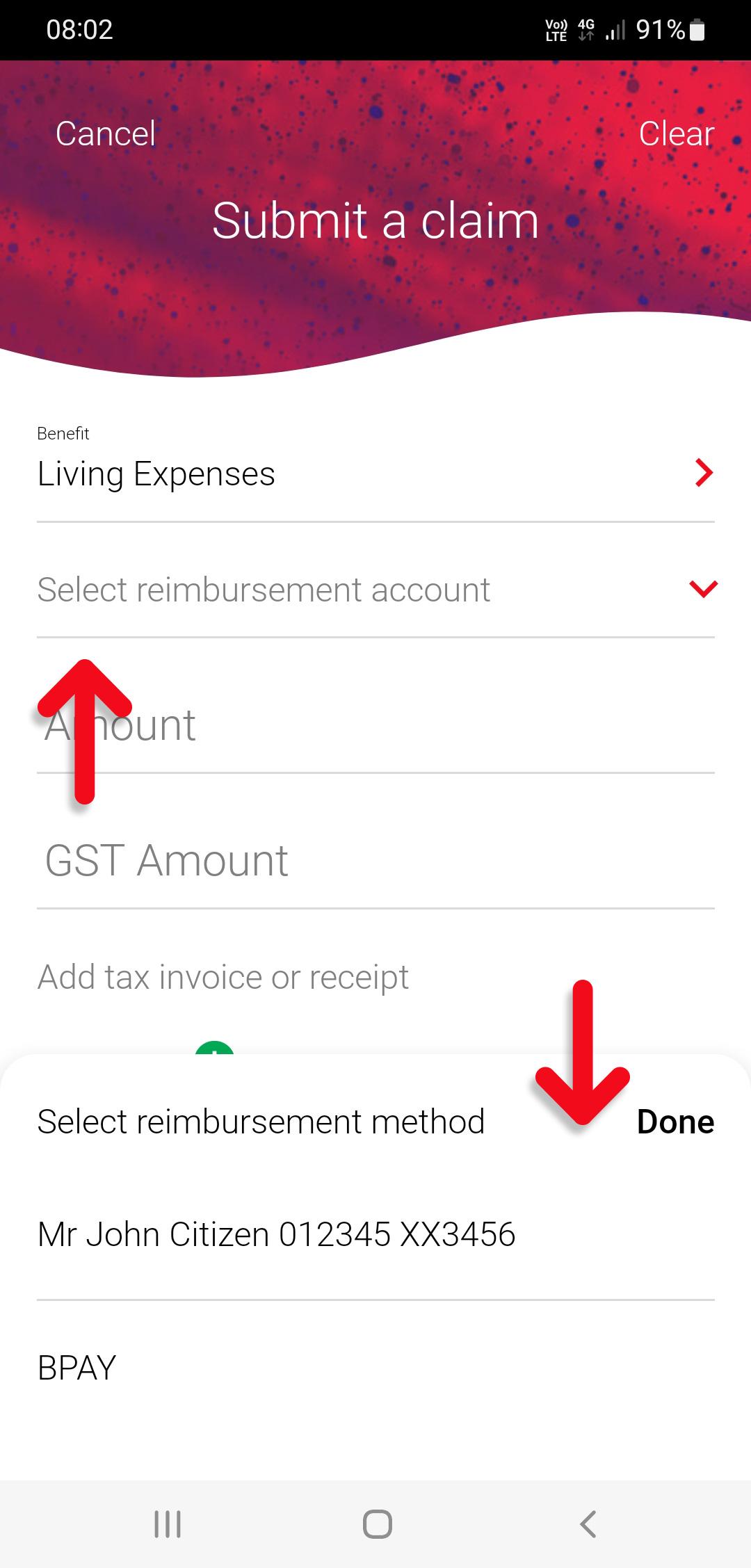

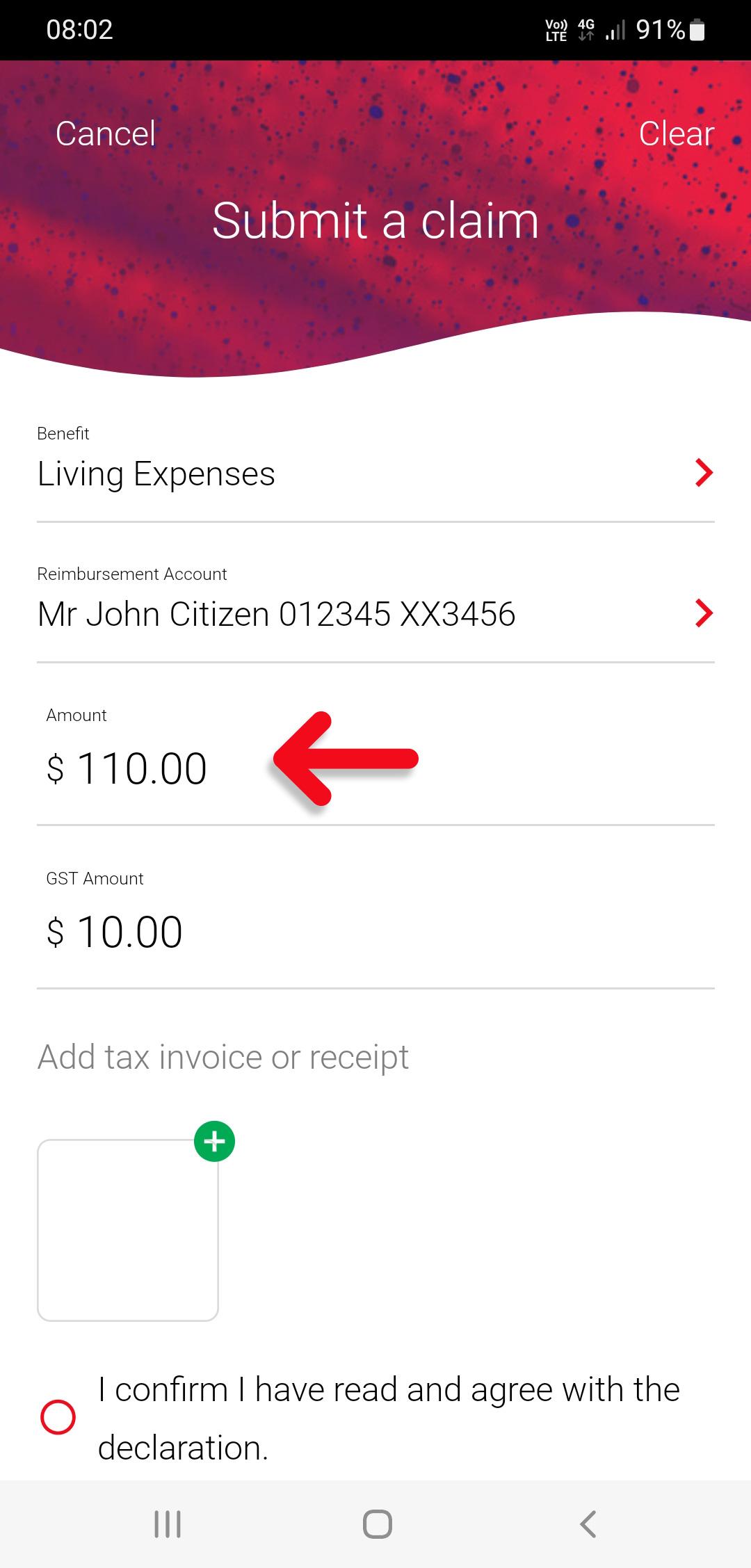

3. Select the Account you would like the claim reimbursement to be paid to. To add a new account see our Update your bank details Alternatively you can choose BPAY to have your claim paid directly to the supplier.

4. Enter the amount of the claim and the GST amount.

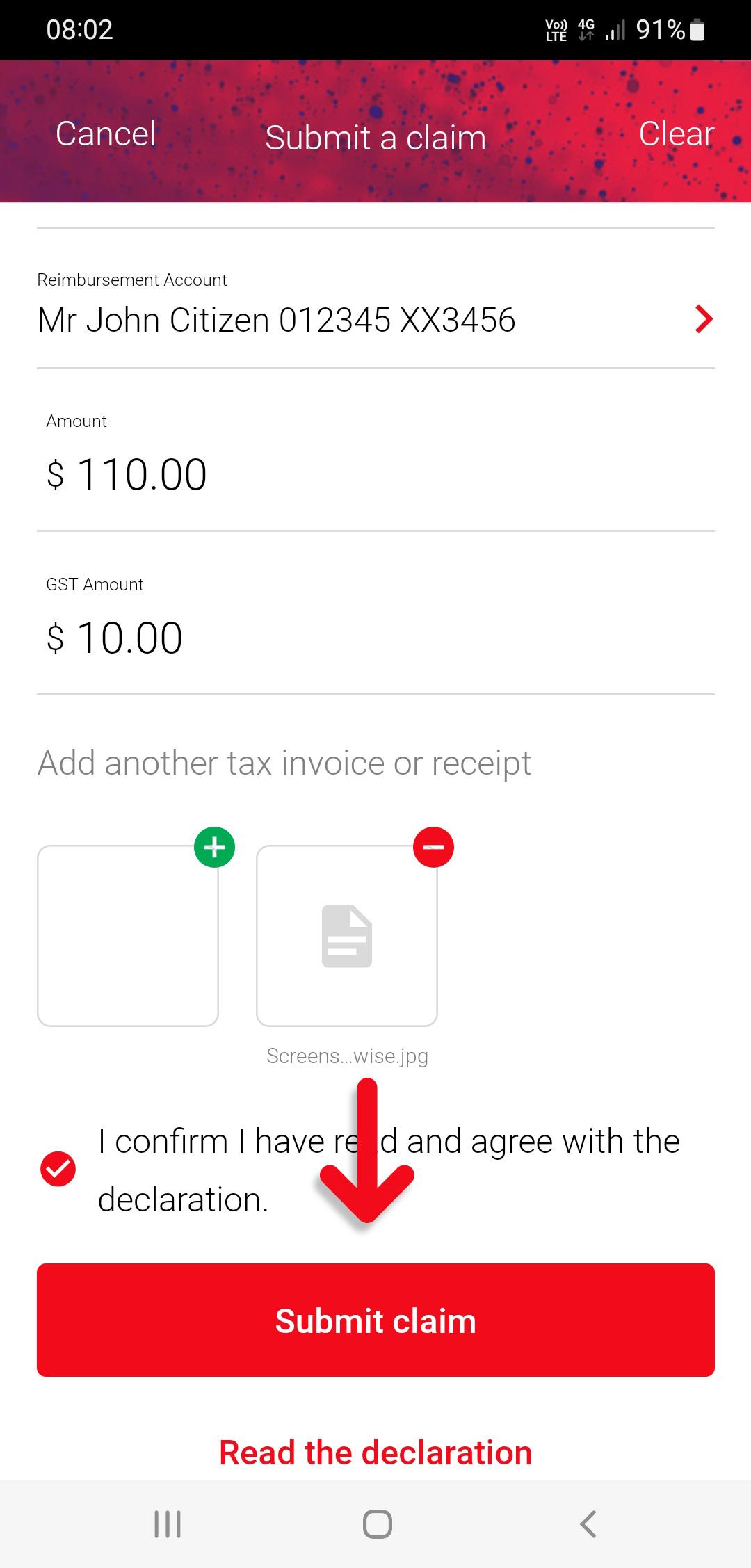

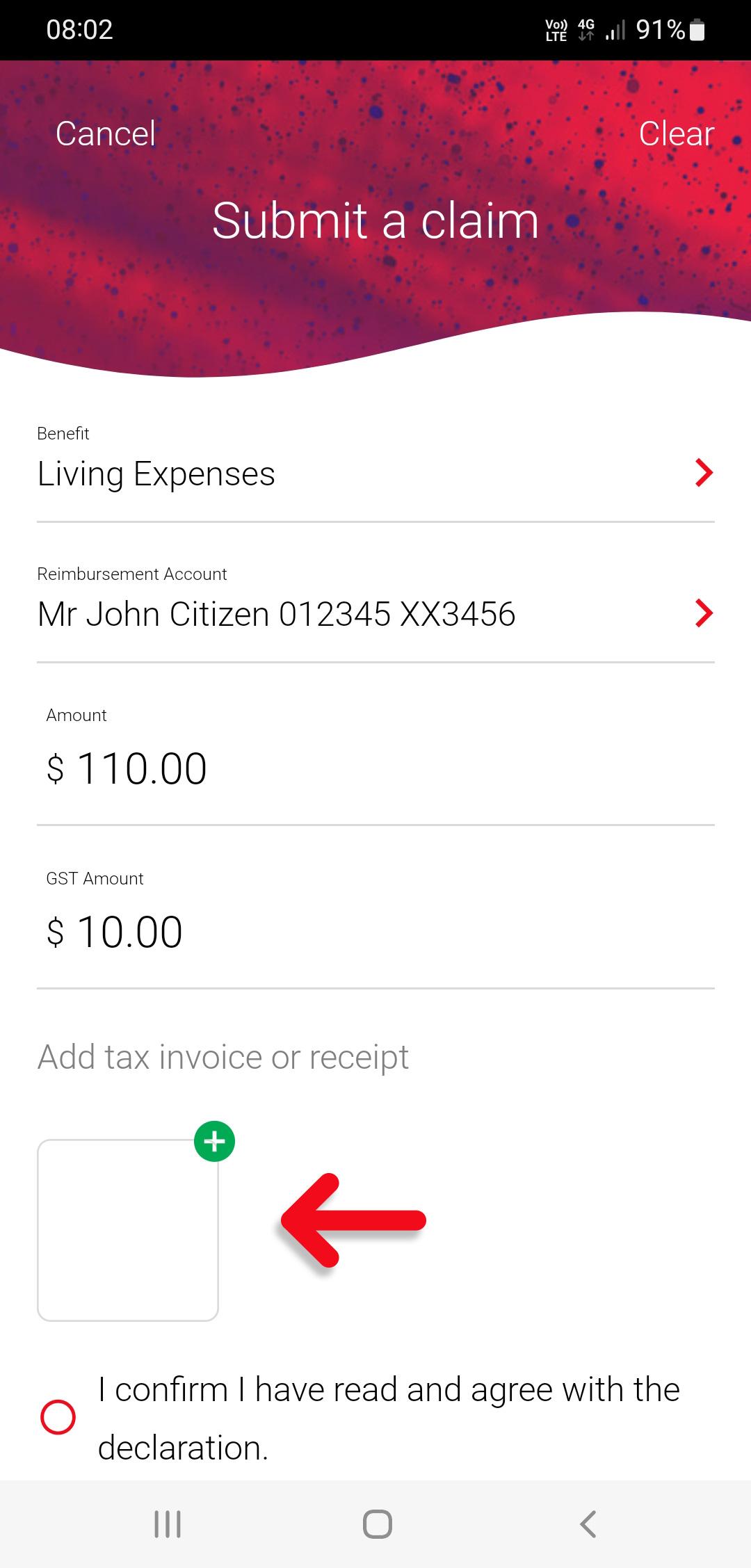

5. Choose the plus symbol to upload a copy or photo of the receipt from your photos, camera or documents.

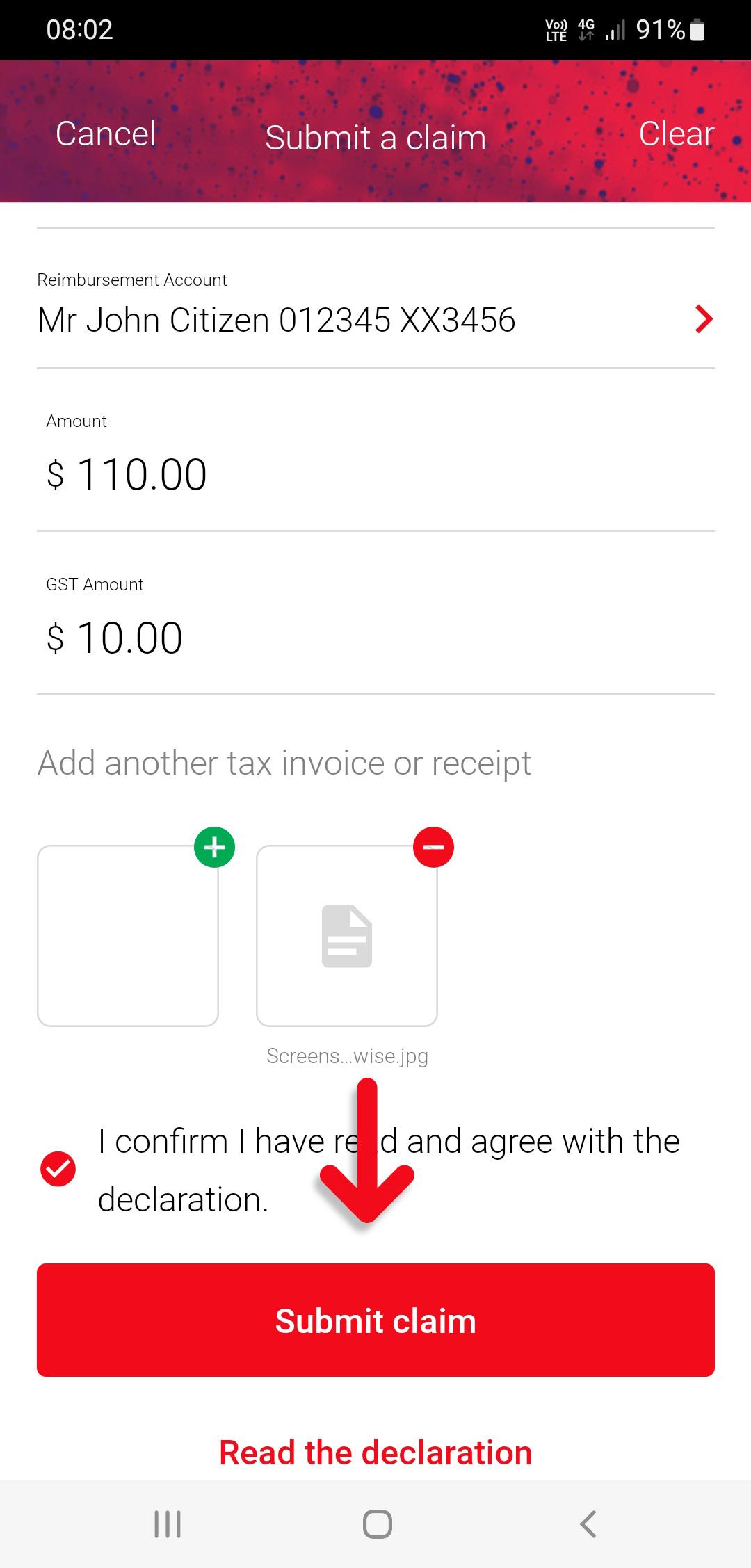

6. Read the declaration, Confirm you have read it and choose the ‘Submit claim’ button

Paywise App instructions.

1. Once you’ve opened and logged in, choose ‘Claims’ in the footer menu, then ‘New Claim’ at the top of the screen.

2. Choose the benefit your claim relates to, eg ‘Living expenses’.

3. Select the Account you would like the claim reimbursement to be paid to. To add a new account see our Update your bank details Alternatively you can choose BPAY to have your claim paid directly to the supplier.

4. Enter the amount of the claim and the GST amount.

5. Choose the plus symbol to upload a copy or photo of the receipt from your photos, camera or documents.

6. Read the declaration, Confirm you have read it and choose the ‘Submit claim’ button

Member Portal instructions.

1. Login to your Member Portal (click here)

2. Click on the ‘Hand Icon‘ next to the benefit you wish to submit your claim for.

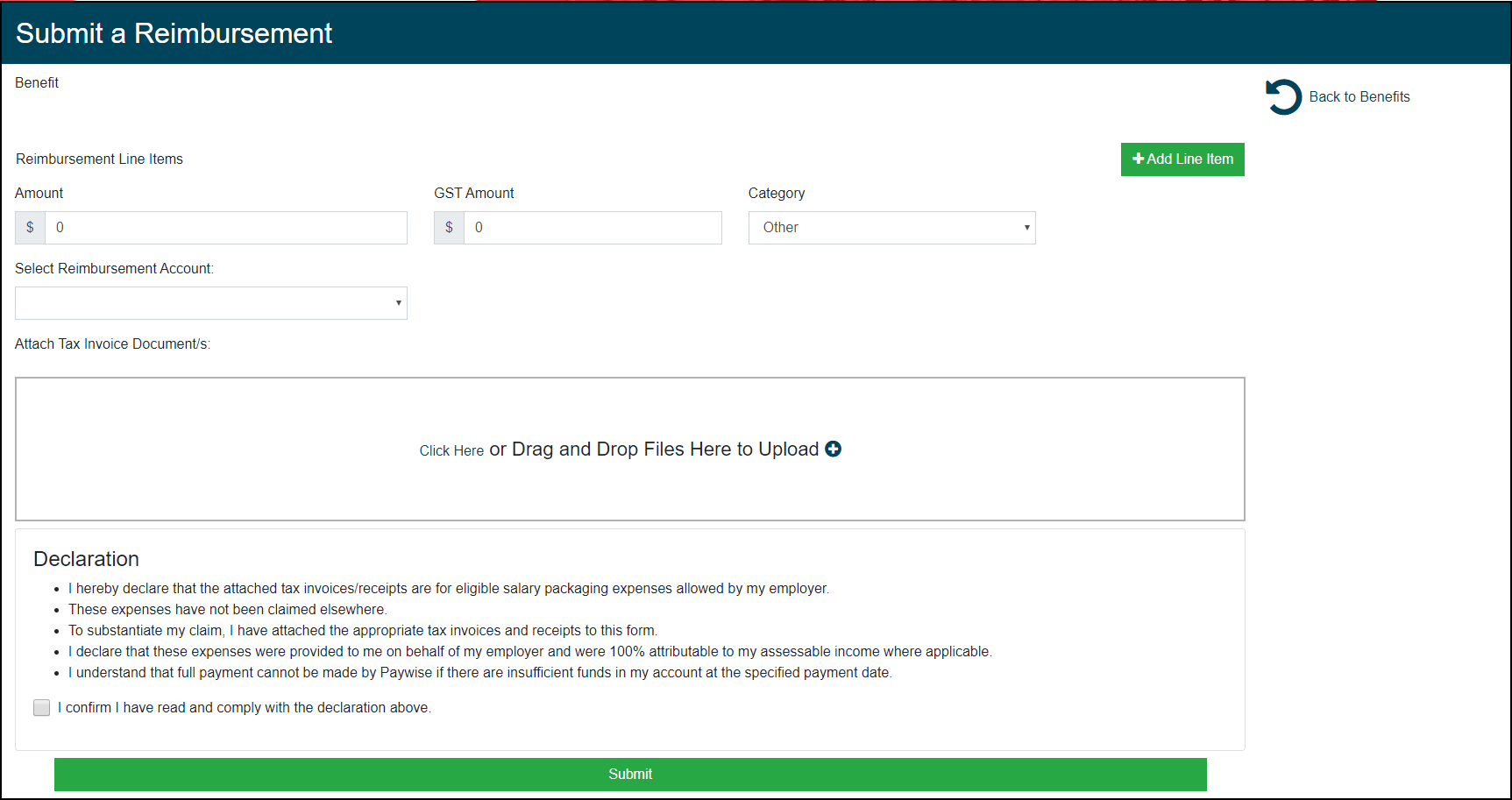

3. Complete the mandatory fields below in order to submit your claim:

- Amount: Total amount of your claim as stated on your tax invoice/bank statement inclusive of GST.

- GST Amount: As stated on your tax invoice. $0 if no GST is applicable.

- Category: Applicable only for vehicle benefit claims. Please specify the type of vehicle expense (e.g. fuel, tyres, registration etc)

- Select Reimbursement Account: Bank account or BPAY details for payment of the claim. BPAY allows for payments to be made directly to suppliers. Please ensure you allow sufficient time before any payment deadlines. To manage your Reimbursement Accounts please see below.

- Attach Tax Invoice Document/s: Upload your tax invoices/bank statement supporting the claim.

- Declaration: Read and acknowledge the declaration.

Manage Reimbursement Accounts Details:

For instructions on providing or updating your bank account details for reimbursement claims, please click here.